QuickBooks Payroll

Explore the power and ease of QuickBooks Assisted Payroll.

QBO Core, Premium & Elite Payroll

Feature Comparisons

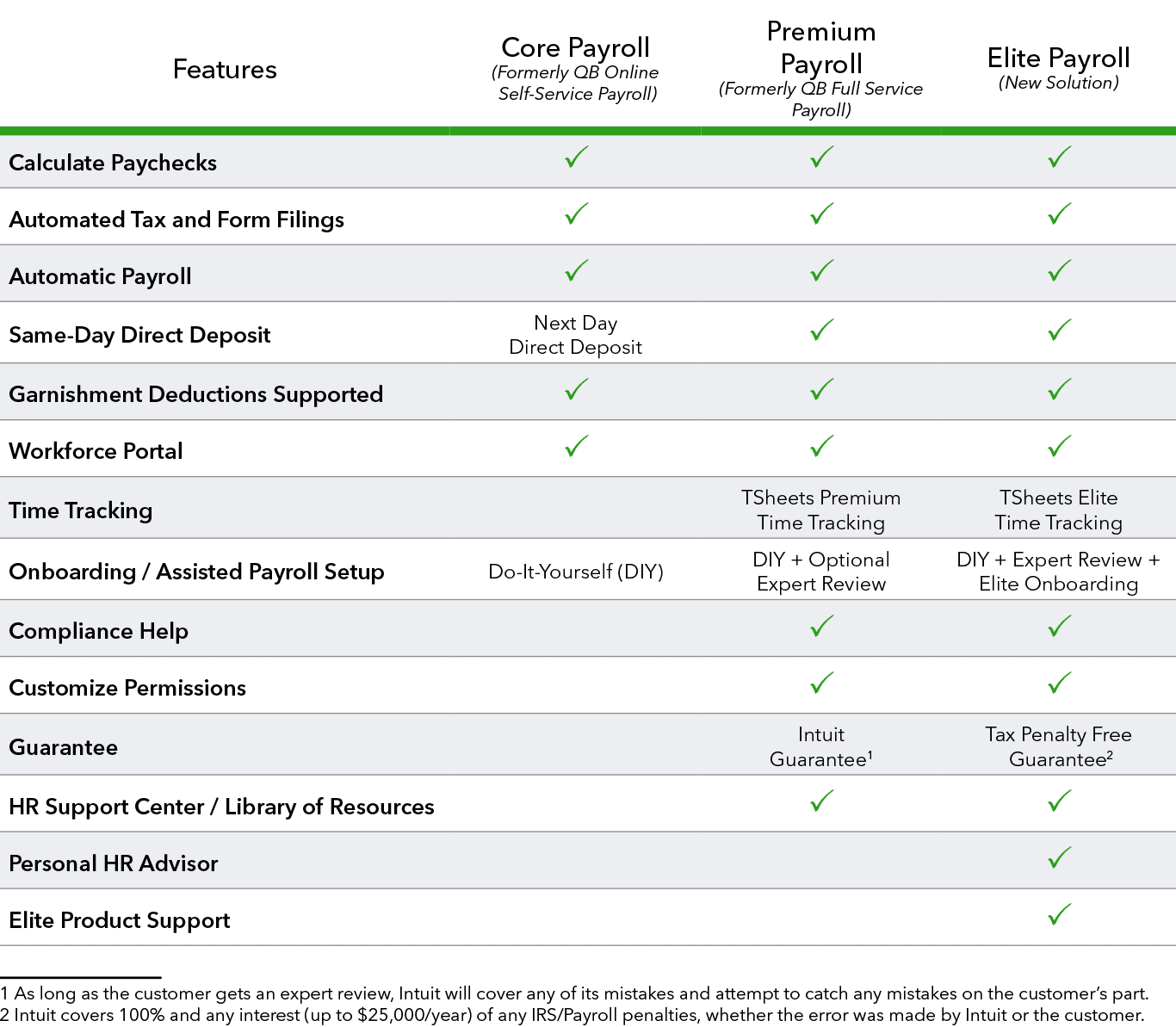

PAYROLL FEATURES

In order to meet customer and market demands, QBO is introducing three new and updated payroll solutions: Core, Premium and Elite. Below is a overview of the features included in each solution.

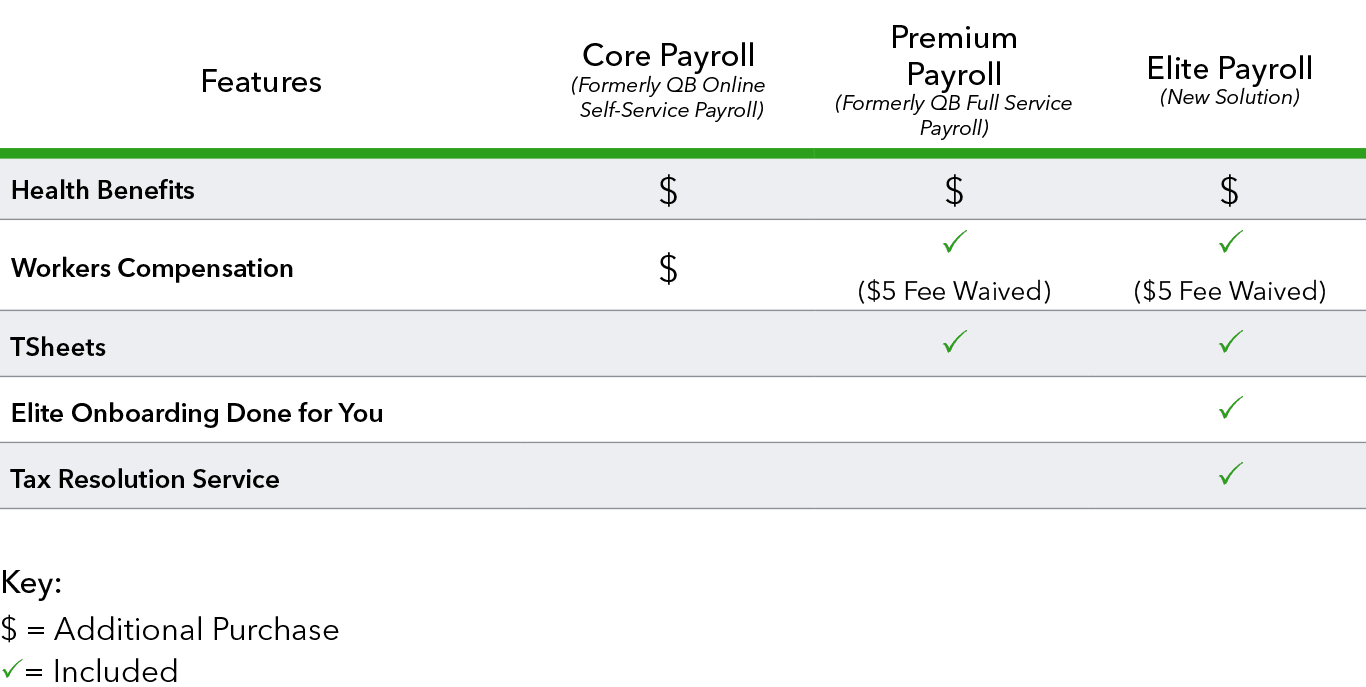

ADDITIONAL SERVICES

Below is an overview of the additional services that are included or can be added to QBO Core, Premium, and Elite Payroll.

Request Additional Information from a dedicated Intuit Payroll Specialist